- #Municiple bond defaults how to#

- #Municiple bond defaults professional#

- #Municiple bond defaults free#

Learn how to find issuer homepages on EMMA. Some issuers hyperlink to those webpages from their homepage on EMMA. Note that many issuers maintain websites or webpages specifically for investors in their municipal bonds.

Market statistics about overall trading patterns and most active securities. Calendar of upcoming economic reports and events that may have an impact on the municipal bond market. Calendar of municipal securities scheduled to be offered. Yield curves and indices from third-party providers. Information about 529 savings plans and ABLE programs. Trade prices, yields and other data about a bond’s trading history. Credit ratings information for rated bonds. Other ongoing disclosure documents about events affecting the bond. Financial disclosure documents from the issuer of the bond. Official statements (the prospectus for a municipal bond). Information about Specific Municipal Securities #Municiple bond defaults free#

The Municipal Securities Rulemaking Board’s Electronic Municipal Market Access (EMMA®) website provides free public access to municipal securities documents and data. Where can investors find information about municipal bonds? In cases where the conduit borrower fails to make a payment, the issuer usually is not required to pay the bondholders. These “conduit” borrowers typically agree to repay the issuer, who pays the interest and principal on the bonds. In addition, municipal borrowers sometimes issue bonds on behalf of private entities such as non-profit colleges or hospitals. Some revenue bonds are “non-recourse”, meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

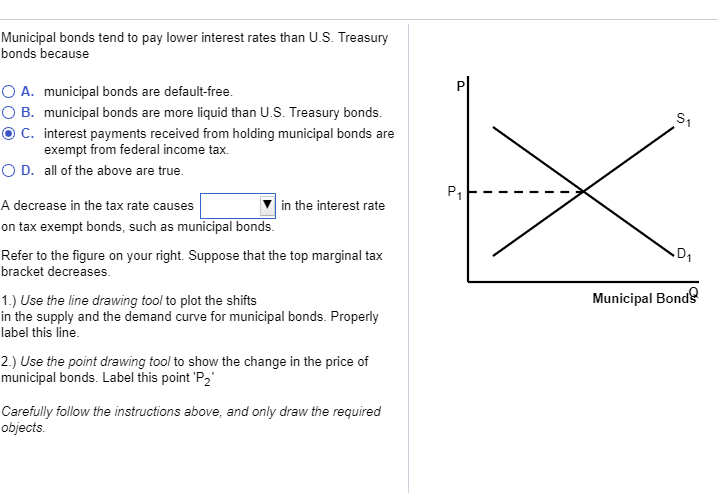

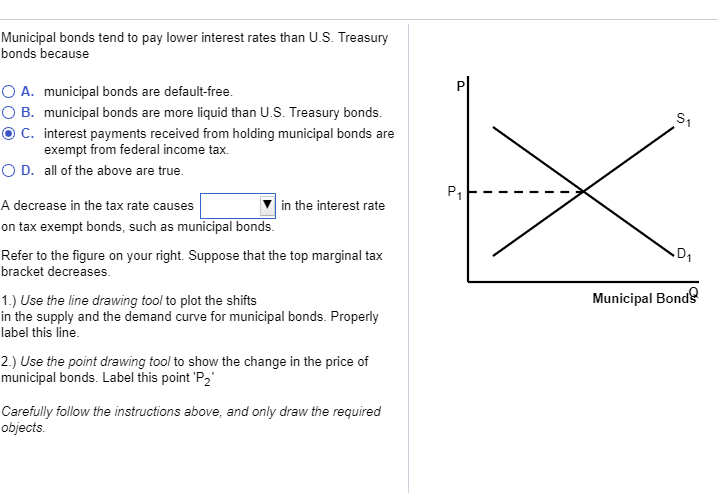

Revenue bonds are not backed by government’s taxing power but by revenues from a specific project or source, such as highway tolls or lease fees. Instead, general obligation are backed by the “full faith and credit” of the issuer, which has the power to tax residents to pay bondholders. General obligation bonds are issued by states, cities or counties and not secured by any assets. The two most common types of municipal bonds are the following: Given the tax benefits, the interest rate for tax-exempt municipal bonds is usually lower than on taxable fixed-income securities such as corporate bonds with similar maturities, credit qualities and other items. Bond investors typically seek a steady stream of income payments and, compared to stock investors, may be more risk-averse and more focused on preserving, rather than increasing, wealth. The interest may also be exempt from state and local taxes if you reside in the state where the bond is issued. Generally, the interest on municipal bonds is exempt from federal income tax. Short-term bonds mature in one to three years, while long-term bonds won’t mature for more than a decade. By purchasing municipal bonds, you are in effect lending money to the bond issuer in exchange for a promise of regular interest payments, usually semi-annually, and the return of the original investment, or “principal.” A municipal bond’s maturity date (the date when the issuer of the bond repays the principal) may be years in the future. Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations and to finance capital projects such as building schools, highways or sewer systems. The Laws That Govern the Securities Industry. Researching the Federal Securities Laws Through the SEC Website.

Structured Notes with Principal Protection.Smart Beta, Quant Funds and other Non- Traditional Index Funds.Mutual Funds and Exchange-Traded Funds (ETFs).Publicly Traded Business Development Companies (BDCs).Stock Purchases and Sales: Long and Short.

Pay Off Credit Cards or Other High Interest Debt.Public Service Campaign (new) – “Investomania”.Required Minimum Distribution Calculator.

#Municiple bond defaults professional#

Investment Professional Background Check. Working with an Investment Professional. Five Questions to Ask Before You Invest.

0 kommentar(er)

0 kommentar(er)